TAP & PAY (Soft POS)

A Scheme-Compliant, PCI CPoC™ Certifed merchant payment app. Accept payments without having to invest in any hardware or commit to month-long contracts.

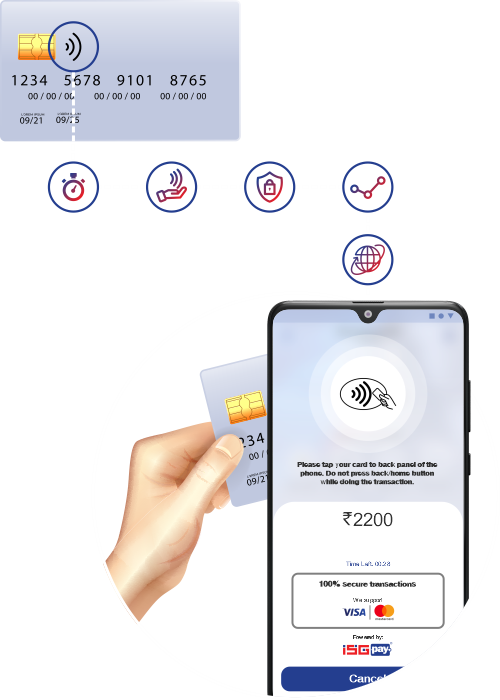

Touch-free & Hassle-free transactions

A Scheme-Compliant, PCI CPoC™ (Contactless Payments on COTS) Certifed merchant payment app with contactless payment acceptance on a merchant's consumer device using an embedded (near-field communications) NFC interface.

So, if you are a merchant you can convert your smartphone to a SOFT POS machine using ISGPay #SmartMerchant which is available on Android Play Store and soon launching for iOS platform.

Benefits: Tap & Pay (Soft POS)

- Install from play store & you are good to go

- No need to invest in cost and maintenance OF hardware based POS terminals

- Faster TAT of Application to First Transaction

- Acquirer doesn’t need to bother about the inventories of EDCs, Paper Rolls, Batteries etc.

- Drastic savings in terms of the service teams

Frequently asked questions

Enabling tap to pay on your merchant acceptance app involves the following steps:

- Ensure that your smartphone supports NFC feature.

- From top bar, settings area of phone switch on the NFC.

- In ISGPay SmartMerchant, click on Tap & Pay option to run the initial checks and setup.

- Enter the amount of the invoice and proceed to accept payment.

- Tap the NFC-enabled credit or debit card of your customers on the back of your smartphone for a few seconds till you receive a confirmation notification with a beep sound.

Yes, Tap & Pay, also known as contactless payments, is generally considered safe and secure. Here are some key security features:

- Encryption: Contactless transactions use encryption technology to protect sensitive information during transmission.

- Tokenization: Instead of transmitting actual card details, a unique token is used, adding an extra layer of security.

- Transaction Limits: There are typically limits on the value of contactless transactions, reducing the risk associated with potential misuse.

- Authentication: Some transactions may require additional authentication, such as entering a PIN for higher-value payments.

While Tap & Pay is secure, both merchants and customers need to follow best practices for card security, such as regularly monitoring transactions and reporting any suspicious activity.

To determine if your card is contactless, look for the contactless symbol on the card. The symbol often resembles a series of four curved lines, similar to a Wi-Fi symbol. Additionally, your card may have the word “Contactless” printed on it.

If you are unsure whether your card supports contactless payments, you can:

- Check with your bank or card issuer. They can provide information about your card’s features and guide you on using contactless payments.

- Review the documentation or materials that came with your card, as it may indicate whether it is contactless-enabled.

Remember that contactless payment technology may vary by region and financial institution, so it’s advisable to check with your specific card issuer for accurate and up-to-date information.